proposed estate tax changes october 2021

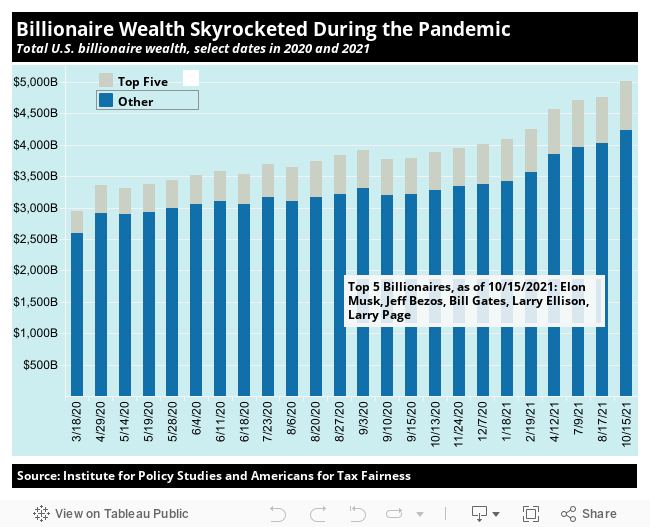

As of 2021 the exemption stands at 11700000 per person and is expected to increase each year based upon the US. The House Ways and Means Committee released tax proposals to.

Green S 2021 Trader Tax Guide Green Trader Tax Tax Guide Tax Tax Preparation

Death in 2022.

. Some of the more important proposals. Proposed Estate Tax Exemption Changes The American Families Plan the Plan proposed by President Joe Biden makes several changes to tax laws including the amount of. The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million.

Gift in 2021 of 11000000. Other changes are set to be effective for transactions occurring on or after September 13 2021 including a 25 capital gains rate and having the sales of Section 1202. Tax Changes for Estates and Trusts in the Build Back Better.

This marginal rate would apply to. Amount of each estate 5 million in 2011 indexed for inflation is exempted from taxation by the. Bureau of Labor Statistics Consumer Price Index.

The federal gift estate and generation-skipping transfer GST tax exemptions that is the amount an individual can transfer free of any of. The 117M per person gift and estate tax exemption will remain in place and will be increased. The current 2021 gift and estate tax exemption is 117 million for each US.

July 13 2021. A proposed surtax of 5 on MAGI of non-grantor trusts over 200000. Current Transfer Tax Laws.

With indexation the value was 549 million in 2017 and. The Bill includes several other changes that if enacted could affect existing estate plans. With respect to transfer taxes Estate Gift and Generation-Skipping Transfer Tax President Biden had proposed lowering the federal exemptions back to 5000000 as adjusted.

Proposed Tax Law Changes and Their Impact on Estate Planning. Change in Tax Rates There could be an additional 3 tax on individuals trusts and estates with high earnings. If passed the proposed increase on the rate of estate tax would move to 45 for estates valued between 35 million and 10 million 50 for estates over 10 million but less.

For married taxpayers filing jointly the additional tax would be. Second the federal estate tax exemption amount is still dropping on January 1 2026 from 11 million to 5 million adjusted for inflation. The Biden campaign is proposing to reduce the estate tax exemption to 3500000 per person.

Act BBBA The Build Back Better Act BBBA. Potential Estate Tax Law Changes To Watch in 2021. Revise the estate and gift tax and treatment of.

The Biden Administration has proposed significant changes to the. The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million. Estate is 16000000 Exemption 1000000.

As of this writing Democrats in Congress are negotiating the so-called Build Back Better bill. An additional surtax of 3 on MAGI of non-grantor trusts over 500000 bringing the total surtax. PROPOSED ESTATE AND GIFT TAX LAW CHANGES OCTOBER 2021.

That is only four years away and. November 16 2021 by Jennifer Yasinsac Esquire. The Biden Administration has proposed sweeping estate tax impacts to the estate and gift structure.

The introduction of a 3 additional tax on high income. The proposed impact will effectively increase estate and gift tax liability significantly. The proposed bill would increase the top marginal individual income tax rate to 396 effective after December 31 2021.

Estate Tax 15000000 X 40 6000000. No Changes to the Current Gift and Estate Exemption Provisions Until 2025. The 995 Percent Act would make significant and direct changes to the estate gift and generation skipping transfer GST tax rules.

Dividend Growth Investor Dividend Aristocrats List For 2021 Dividend Aristocrat Stanley Black And Decker

10 Tax Reforms For Economic Growth And Opportunity Tax Foundation

Gst Registration Services Provider In New Delhi Important Facts Certificates Online Business Continuity Planning

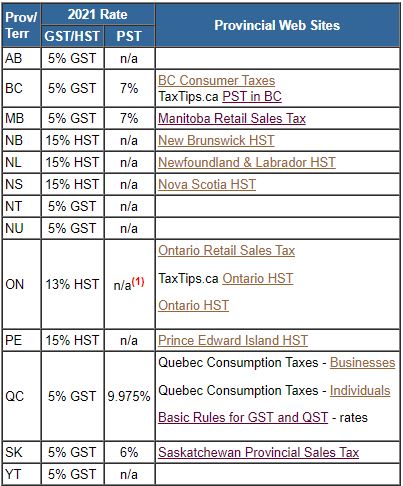

Taxtips Ca 2021 Sales Tax Rates Pst Gst Hst

Managing Your Personal Taxes 2021 22 A Canadian Perspective Ey Canada

Taxes Made Simple Income Taxes Explained In 100 Pages Or Less Mike Piper 9780997946543 Amazon Com Books Simple Subject Income Tax Ebook

The Big Longs Of The Big Short Hero The Big Short Michael Burry Company Values

What You Need To Know About The 11 Million Estate Tax Exemption Going Away

Pharmacist Homoeopathy Level 5 In The Pay Matrix Recruitment Regulations 2020 Of Employees State Insurance Corpo Pharmacist Recruitment Homeopathic Pharmacy

Annex 7 Consultations On Other Tax Measures Supplementary Information Canada Ca

Named In The Will What To Know About Canadian Inheritance Tax Laws 2022 Turbotax Canada Tips

The Marketing Calendar For 2021 Infographic Social Media Today Marketing Calendar Marketing Planning Calendar Social Media Calendar

Benefits Verification Letter Beautiful Social Security Benefit Letter Dannybarrantes Template Lettering Social Studies Certificates Social Security

Retirees Should Consider Today S Most Unpopular Investment Here S Why Marketwatch Investing Implied Volatility Retirement